5 Property History Research Tools You Should Know About

Table of Content

- View houses in Dallas that sold recently

- Real Estate Agent

- How Do I Search Public Records for Home Ownership?

- Housing-Market Mayhem: U.S. Home Sales Likely to Hit Record High of $2.5 Trillion In 2021

- Buying & Selling Stock

- Thinking About Writing a Love Letter to the Seller of Your Dream Home? It’s Not Always a Good Idea

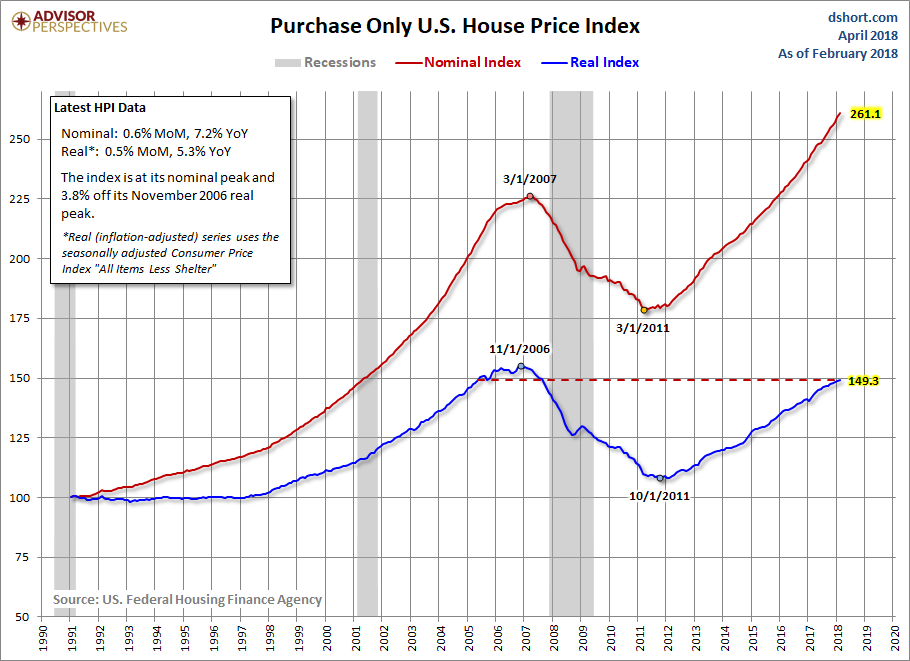

Note that normalization dates do not affect measured appreciation rates. FHFA uses data supplied by Fannie Mae and Freddie Mac in compiling the HPI. Each of the Enterprises had previously created a weighted repeat-transactions index based on property matches within its own database. In the first quarter of 1994, Freddie Mac began publishing the Conventional Mortgage Home Price Index . Appraisal values from refinance mortgages are added to the purchase-only data sample.

The claims information in this report will include information on the date of the property loss, as well as amounts paid. Previous claims against a property can impact your insurance premiums and may need to be factored into your bid price. The Resource forum is where you may discover that the type of house you’re considering buying is perfect for your needs … or is going to be way more effort to maintain than you want to expend.

View houses in Dallas that sold recently

It serves as a timely, accurate indicator of house price trends at various geographic levels. It also provides housing economists with an analytical tool that is useful for estimating changes in the rates of mortgage defaults, prepayments and housing affordability in specific geographic areas. The HPI is a measure designed to capture changes in the value of single-family houses in the U.S. as a whole, in various regions and in smaller areas. The HPI is published by the Federal Housing Finance Agency using data provided by Fannie Mae and Freddie Mac. The Office of Federal Housing Enterprise Oversight , one of FHFA’s predecessor agencies, began publishing the HPI in the fourth quarter of 1995.

Property sales history records are indeed public records, and so you do have access to them. You can typically find these records at the city or county level where the home is located, usually at the office of the recorder of deeds. You can also find important information about the property at the tax assessor's office, which will either by for the city or the county. Click on the “Recently Sold” link at the bottom of the search tool area. The page also features many ways to refine your search by geographic area, price range, lot size, square footage and sale date. The database, though, are usually limited to the last 36 months of home sales.

Real Estate Agent

These property records can usually be found in one location where the records have been recorded and also can be researched. Documents include deeds, liens, mortgages and releases to name a few. Most recorder's offices can be found locally, at the county level, within a given state.. Properties marked with the Triad MLS, Inc. icon are provided courtesy of the Triad MLS, Inc.’s, Internet Data Exchange Database. It was the ninth straight month of falling sales as home prices remained elevated and a 30-year fixed mortgage rate hit a 20-year high pushing many buyers out of the market. Meanwhile, the total housing inventory fell 0.8% to 1.22 million units.

Listing information is from various brokers who participate in the Bright MLS IDX program and not all listings may be visible on the site. Some properties which appear for sale on the website may no longer be available because they are for instance, under contract, sold or are no longer being offered for sale. Property information displayed is deemed reliable but is not guaranteed. Copyright 2022 Bright MLS, Inc. (/info/mls-disclaimers/#mls_5632) The listing broker’s offer of compensation is made only to participants of the MLS where the listing is filed. IDX information is provided exclusively for personal, non-commercial use, and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. The listing broker’s offer of compensation is made only to participants of the MLS where the listing is filed.

How Do I Search Public Records for Home Ownership?

RealtyTrac offers members the ability to check foreclosure history and current status of any property. Depending on the reason for the foreclosure, you can get a great deal on a property, especially if it’s preforeclosure or if you’re the first one to snap it up. If you’re ready to truly don the hat of researcher and delve far back into a property’s history, then there’s the official federal lands records site.

The median existing-home price for all housing types was $379,100, up 6.6% from October 2021. Properties typically remained on the market for 21 days in October, up from 19 days in September. The data relating to real estate for sale on this web site comes in part from the IDX Program of the Greater El Paso Association of REALTORS®.

Beginning in March 2008, OFHEO (one of FHFA’s predecessor agencies) began publishing monthly indexes for census divisions and the U.S. FHFA does not publish a repeat purchase index for the eleven metropolitan areas comprised of metropolitan divisions. Therefore, Moody's Analytics estimates a repeat purchase index for these areas . This series is created from a weighted average of the metropolitan division repeat purchase indices. Moody's Analytics estimates of home sales by metropolitan division are used as the weights. Use prices from sales transactions of mortgage data obtained from the Enterprises.

The specific amount of closing costs will vary depending on where you buy your home and the type of loan that you get, but saving between 3-6% of your home’s value is a good rule of thumb. We’ll use your credit report to determine these monthly debt obligations and calculate your DTI. Debt-to-income, sometimes called DTI, is calculated by dividing your monthly debt by your gross monthly income.

This site is not authorized by the New York State Department of Financial Services. No mortgage applications for properties located in the state of New York will be accepted through this site. Although such an option might exist from time-to-time, most homeowners need to have some cash for a down payment. For $12, the site will compile a report that tells you whether a death has occurred in your home and when it happened. Beyond that, it will also tell you if there have been any fire incidents or meth activity in the house. But the website DiedInHouse.com will tell you whether anyone has died in your home.

Therefore, we promote stricteditorial integrity in each of our posts. PK started DQYDJ in 2009 to research and discuss finance and investing and help answer financial questions. He's expanded DQYDJ to build visualizations, calculators, and interactive tools. So, it's about as reasonable as looking at any US-aggregated data.

Once you have located the correct office, walk in during normal business hours and explain what you are looking for. Someone there should be able to assist you in getting started on your search and obtaining the information you need. You may be charged a fee for the search as well as any copies you take with you. Economic Research Resources Explore resources provided by the Research Division at the Federal Reserve Bank of St. Louis. When buying a house, you might want to know the home’s past value.

The final few steps in the process are to review your Closing Disclosure 3 days before closing. This document will tell you exactly what you need to pay at closing and summarize all of your loan details. Your home.com by Homefinity loan officer will walk through this document with you. If, after your inspection, there are any significant issues you can ask for the seller to correct or compensate you for the necessary repairs.

According to Black Knight, a longstanding real estate and mortgage analytics company, annual home price growth has seen a 25-year average of 3.9%. In 2019, average yearly price gains slipped slightly to 3.8%, marking the first shrink in gains since 2012. Sherry Ajluni, a top real estate agent in Cumming, Georgia, agrees. “Even if home prices go down over the next couple of years as inventory goes up, they will most likely be back up by year three or four,” she says. If California, Texas, or New York change housing policies, it can move the whole country's median home price. Home prices have an extensive span, and there are some wildly expensive properties in the United States.

That is, the HPI equals 100 for all MSAs in the first quarter of 1995. States and divisions are normalized to 100 in the first quarter of 1980. The purchase-only indexes are normalized to 100 in the first quarter of 1991.

Comments

Post a Comment